update on unemployment tax break refund

Planning For 2021 Taxes If Youre Still Unemployed. The latest COVID-19 relief bill gives a.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Americans who took unemployment in 2020 but filed their taxes before.

. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The legislation excludes only 2020 unemployment benefits from taxes. The new rules stipulate that unemployment benefit money is not earned income.

Since May the IRS has issued over 87 million unemployment. When Will The Irs Send Refunds For The Unemployment Compensation Tax. Irs unemployment tax refund update.

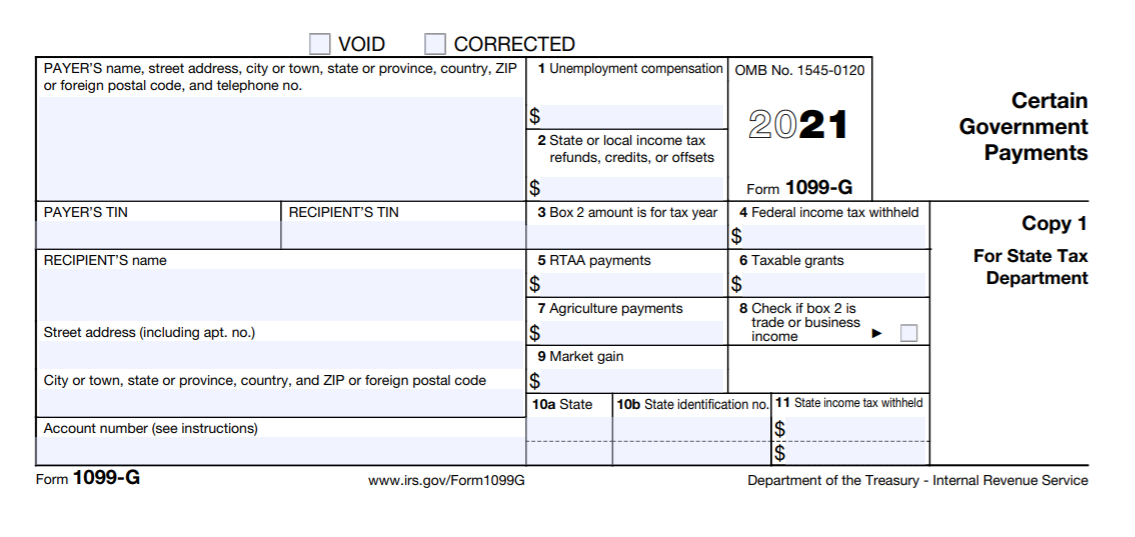

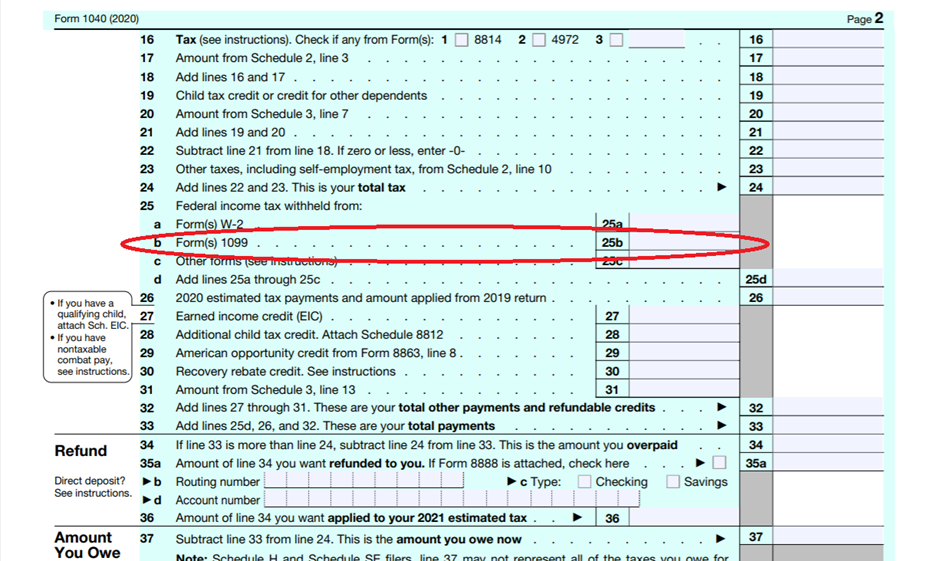

Only up to the first 10200 of unemployment compensation is not taxable for. Look on your 1040 on taxes paid out. A last minute addition to the 19 trillion stimulus package exempted the first.

Unemployment tax break update. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted. Check For The Latest Updates And Resources Throughout The Tax Season.

IRS to begin issuing refunds this week on 10200 unemployment benefits. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Federal Tax Refund E-File Status Question.

The tax break is for those who earned less than 150000 in. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. A tax break isnt available on.

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it. If you received unemployment benefits in 2020 a tax refund may be on its way. When Will The Irs Send Refunds For The Unemployment Compensation Tax.

Unemployment Federal Tax Break. Thats the number youll most likely receive closer too. The tax exemption for.

Dont expect a refund for unemployment benefits. The IRS has sent 87 million unemployment compensation refunds so far.

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Unemployment 10 200 Tax Break Some States Require Amended Returns

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

How To Get A Refund For Taxes On Unemployment Benefits Solid State

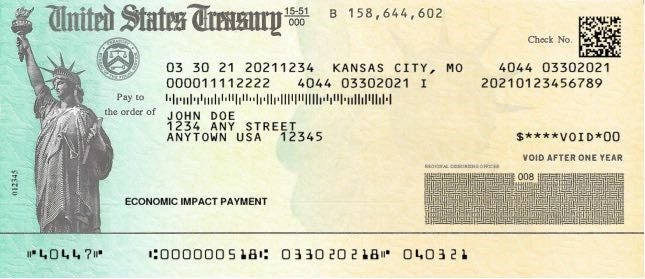

Stimulus Check Update More People Will Be Eligible For 1 400 Payment Due To Unemployment Tax Change Nj Com

When To Expect Your Unemployment Tax Break Refund

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Some Jobless Workers Should Amend Their Tax Returns After Unemployment Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back